Did you know Jim’s Building Inspections have now started providing Tax Depreciation Schedules for Property Investors around the country?

Why?

Our Inspectors are in thousands of homes and apartments everyday conducting Pre-Purchase Building Inspections, many of these are for Investment Property. So, make the best use of us while we are there, and we can complete your Tax Depreciation Schedule at the same time.

What is a Tax Depreciation Schedule?

When you own investment (rental) property, the value decreases every year due to depreciation. But the great news is you can claim a tax deduction on these depreciated amounts every year.

Seasoned property investors will take depreciation into account before purchasing their next investment.

A tax depreciation schedule is also critically important for Investors purchasing newly built apartments, townhouses and homes as at this stage in the life of the property the tax depreciation benefits will be at their highest.

How?

Jim’s has partnered with Depreciator who are professional quantity surveyors to prepare your Tax Depreciation Schedule.

The best news is that both your PrePurchase Building, Pest and Asbestos Inspection and your Tax Depreciation Schedule can be booked with Jim’s in one go and the fee is fully tax deductible for property investors.

Here are some of the basic questions that come to mind when talking about depreciation.

What is Depreciation?

Depreciation is a tax deduction available for the decline in value of any asset over time due to wear and tear. Property depreciation specifically relates to investment properties and refers to the deductions available for the decline in value of a building and its plant and equipment assets over time.

What is a Tax Depreciation Schedule?

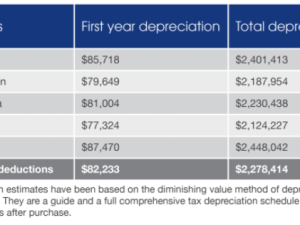

It’s a document that lays out the exact amount of tax deductions for depreciation that you are entitled to claim. Your accountant will use it year after year to ensure you’re claiming the all the deductions that you’re entitled to.

A Depreciation Schedule runs for 20 years for once-off 100% tax deductible fee. Your annual tax deductions can help you cashflow your property. Don’t be one of those investors who fails to claim depreciation deductions.

How can we help you at Jims Building Inspections?

While your accountant can prepare your tax return, they’re not qualified to prepare a tax depreciation schedule. That’s where we come in!

Our team can provide you with a comprehensive Depreciation Schedule that your accountant will love, and all of the information you need to know with regards to your tax deductions, all with the backing of Depreciator, your qualified quantity surveyor.

To enquire or learn more about this service, contact your local consultant and get a free quote.

1 Comment

-

I didn’t realize that as the value of your property depreciates, the taxes will as well. My father purchased a commercial property a few years ago. I wonder if his property has began to depreciate yet. I will have to share this article with him, and see if he has looked into it yet.